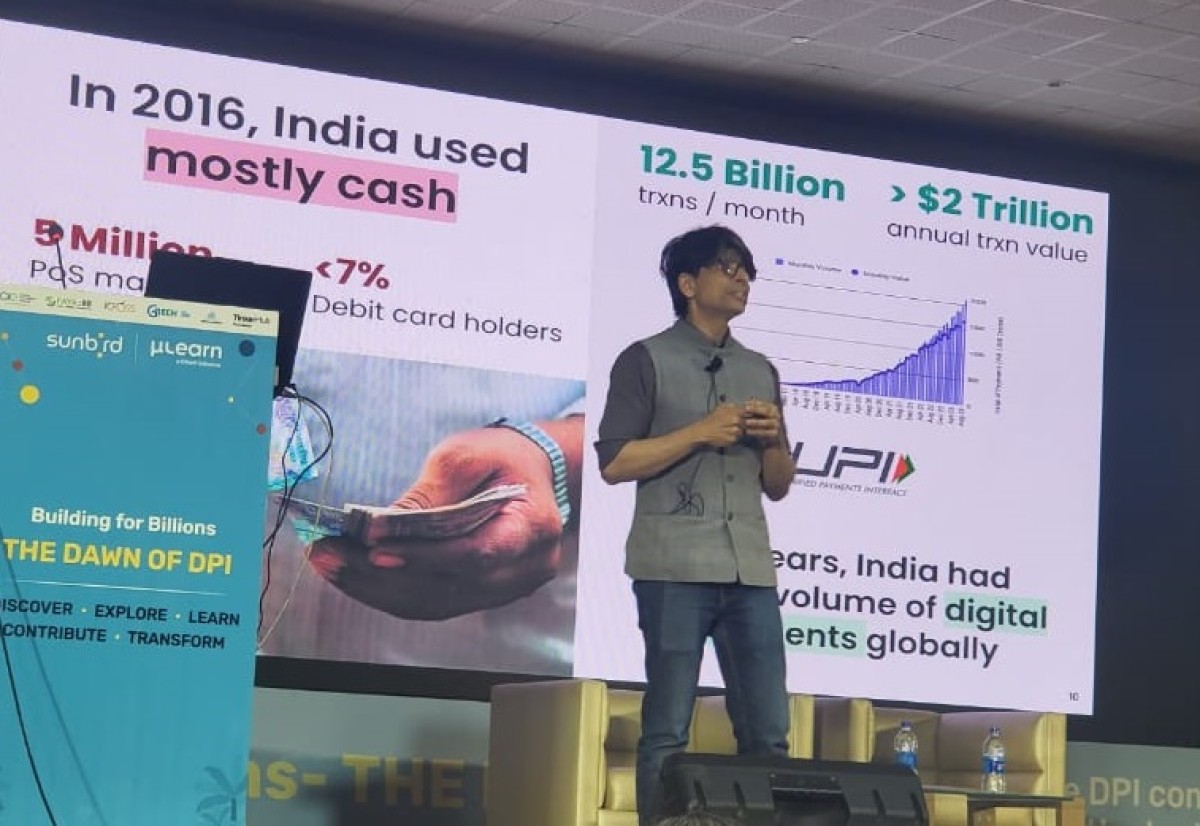

Architect of UPI, Pramod Varma, says India’s open source approach is revolutionary. Photo: TikTalk Newsletter

India’s successful instant digital payment system, called Unified Payments Interface (UPI), is demonstrating to the world a new way to democratise the internet through open-source platforms, said Pramod Varma, the architect of this highly acclaimed money transfer system.

Speaking in Trivandrum last week, Varma outlined the impact UPI has made in the country and revealed that dozens of countries around the world are now looking to build similar open-source platforms across different sectors.

For those bold enough to reimagine market mechanisms, digital public infrastructure (DPI) is proving to be pivotal.

About 50 to 75 countries in the world are going to invest in DPI platforms, he said during an event organised by Sunbird.org along with GTech and MuLearn.

“Wherever DPI goes, Indian innovators have an opportunity,” he said while speaking at an event titled ‘The Dawn of DPI’.

Varma pointed out that India itself is a huge market when you go by the numbers. Delhi Metro does more transactions in a day than Uber does across the entire country.

But we still are chained to paper-based transactions which are clunky and inefficient. Facilities like eSign and Digilocker, which arehigh-trust, low-costmodels,could spur one billion-plus economy in India alone.

The idea behind DPI was like laying down a rail track. It is up to the innovators to imagine what kind of trains can utilise that facility and cater to the needs of the people, said Varma, who was born in Trivandrum and hails from the Kilimanoor royal family.

Underlining the principles behind the creation of UPI, he said the platform was created not just for those with smartphones as it is device agnostic, currency agnostic, channel agnostic, and authentication agnostic. Such ease in adoption is what made it easy for countries like Singapore to embrace it quickly.

During the G20 Summit in New Delhi, an electronic wallet for G20 country citizens was released. It used UPI and enabled visitors from the country to make instant payments when they were in India.

Varma highlighted inclusivity as the strength of the system. UPI now records 300 million transactions that are not conducted through smartphones.

“You go to a touchpoint, put your fingerprint, and transfer money using UPI,” said Varma.

Before 2016, less than 50 million people in India were making digital payments. By the end of 2023, UPI is being used by 500 million people, he said.

“That is inclusive growth as it is not the same 50 million people using UPI to conduct more transactions. It means expanding the pie. More people are now entering the formal sector and have access to the same facilities as others do.”

This development has enabled roadside vendors and small businesses to join the financial mainstream.

“Suddenly, a small vendor can verifiably prove their cash flow, their invoices, and their bill payments. When an individual or an SME's footprint becomes digital and verifiable, suddenly they can use that data as an asset to access finance.”

“That is a significant disruptive change that the whole world is watching."

In India, it is easier for large companies to obtain loans worth crores, but small businesses and individuals find it difficult to secure smaller loans.

For a small business to obtain a loan of 50,000 rupees for a month is almost impossible, as no lender can generate enough interest to cover expenses like credit validation, cost of underwriting, and cost of collection, even if charging 18 percent interest.

An open-sourced account aggregator API system now enables individuals and SMEs to harness all their financial data. Fintech companies can utilise that API to reimagine information flow as an asset to create new financial applications.

“That is huge as it opens up access to capital to many, many small businesses,” he said.

For the first time in the world, this conundrum has been cracked as fintech companies like Kerala’s only unicorn Open Finance are reimagining the system. People are using the combinatorial power to underwrite small loans, and that too in minutes.

But Varma pointed out that the Indian economy still continues to be fragmented. “E-commerce in the country is just 8 percent, which means 90 percent of Indian B2C commerce still happens on the roadside.”

“We cannot afford to leave economic activities fragmented as it results in inefficiency, high costs, and creates asymmetry. All of this leads to frictions in society due to problems like joblessness.”

The major players in the Indian online business scene, like Amazon, Uber, Swiggy, and Zomato, operate on Western models of aggregation, where providers are brought on one side and consumers on the other, with a heavy investment in advertising, hoping it will work.

“Such models do not penetrate deep into the Indian market,” said Varma.

“That leaves the market fragmented. Or if one of the businesses happens to be completely successful, then you have a monopoly. Either way, we are screwed.”

To counter that, we need audacious imagination, akin to the internet structure. The internet is not one platform or one server. It is a completely decentralised system driven by protocols and standards.

So what we need are not siloed platforms, but an open-source structure.

India is making an absolutely audacious attempt to create that through open-source protocol like Beckn to create platforms like ONDC and Bangalore’s Namma Yatri. It is not even the government, but the open-source community that is driving this worldwide.

“The internet opened up a content economy, and what we want to create is a transaction economy.”

The open-source revolution is not limited to commerce, products, and services alone. In Bangalore, four startups have come together to create a platform for green energy trade. They are conducting 3,000 transactions a day.

Varma, who is currently the CTO of a not-for-profit organisation called EkStep Foundation, had played a key role in developing the Aadhar ID system and said his motto then was “Don't collect data you don't need”.

“Never centralise. Never have a mothership to attack.” Like UPI, Aadhar too has no centralisation. He said Aadhar cryptography is ten years ahead of other national ID systems, including that of the US.

“Every column is encrypted with different keys. We have millions of keys, which means even insiders can't tamper with them. Even Aadhar officers can't search the Aadhar database. Trust-no-one-architecture is what we used to call it."

Varma said some countries that are looking to have similar biometric identities are looking to India to provide a model.

The Bangalore-based International Institute for Information Technology released a platform called Modular Open Source Identity Platform (Mosip) for such countries.

Looking ahead, Varma said in the next five to ten years, India will see an explosion of voice-based AI platforms and apps. This will open up the possibility of more peer-to-peer transactions.

Protocols that use forms or combo boxes are too difficult for the majority of users, even if they are familiar with modern technology.

“India’s AI way is going to be voice-based apps, enabling voice-based payments, which is a powerful way to bring in millions of people under its ambit.”

“It can be done even now as 22 language voice models and curated data sets are already available on GitHub as open source. But it is not economically viable due to the cost of high-end chips. In ten years, the cost will go down dramatically, as is the norm with any technology.

Varma says it is like the beginning of the internet. People could not imagine the power of it, and the majority remained sceptical. Some found uses for it, like finding a document and some information.

But nobody at that stage could imagine how the internet was going to shape the future, he said.

Buckle up for an EV race in India

The Indian electric vehicle landscape is gearing up for intense competition following New Delhi's approval of a new policy offering import discounts to foreign car manufacturers willing to establish factories within the country. This policy adjustment presents a significant opportunity for Tesla, as it would substantially reduce the import levies it currently faces, ranging from 70 to 100 percent, down to just 15 percent. Elon Musk’s company should welcome this development, especially as Chinese carmaker BYD has surged ahead of Tesla as the top seller globally.

BYD also had plans for an Indian factory, but New Delhi threw a spanner in the works with a ban on Chinese investments. Sanjay Gopalakrishnan, vice president at BYD's India unit, says the company is now focusing on the premium market and has 24 sales outlets in India. Last week, BYD unveiled a new model called Seal, which costs 40 lakh rupees.

A glittering business model

Gold and bank lockers should go hand in hand. However, the problem in India is that there are a lot of gold shops, but not enough safe deposit lockers. To fill this gap, serial entrepreneur Ganesh Balakrishnan has stepped into the space of private safe storage vaults, starting with Bangalore. His startup plans to partner with banks and real estate developers to build and manage these strong rooms in premium gated societies, reports The Economic Times. The vaults will also have high-tech security features and a dressing room for its clients. This is a golden business plan, we think.

Devin worship fills chatrooms

If you haven’t heard of the firm Cognition AI, you should, especially if you are into coding. This California-based firm has unveiled an AI tool called Devin that can write code and create websites with a single prompt. The demo video is impressive and the internet chatter about this tool is hot. The company is backed by former Twitter executive Elad Gil and PayPal co-founder Peter Thiel’s venture fund. Not surprising, given the profiles of the co-founders who seem to be whizz kids.

Coffee, Tea or Eeeeee …

Those fancy-looking modern chairs often worry us, as the levers can sometimes malfunction, leaving occupants in a state of panic. Now, imagine if this were to happen to a pilot. In a recent incident on a Latam Airlines flight, a flight attendant accidentally hit a switch on the pilot’s seat while serving a meal. This caused the pilot to lurch forward into the controls, resulting in the plane nosediving. Although the pilot eventually regained control, dozens of passengers were injured during the sudden descent. Those chairs, we tell you...